Free Webinar: ShipWorks Insurance

ShipWorks recently hosted a webinar that featured Walt Moscoso and Kyle Gibson from InsureShip covering the ins and outs of shipping insurance. Check out the highlights of the webinar below, along with timestamps for easy viewing.

About InsureShip – At the 39 seconds mark

With more than 16 years in the industry, InsureShip is one of the largest shipping insurance providers in the United States. Unlike many other insurance providers, InsureShip focuses entirely on insuring cargo inside parcels. The company is licensed in all 50 states and offers coverage in 94% of countries world-wide. InsureShip provides easy to understand coverage language devoid of dense legal jargon. Best of all, InsureShip is simple to use as it is integrated within the ShipWorks shipping software!

Benefits of ShipWorks Parcel Insurance – At the 3 minutes 30 seconds mark

ShipWorks Parcel Insurance provides a broad “All-Risk” policy that covers most damaged or lost packages. The policy provides premium coverage at less-than-carrier pricing—all with a simple and easy claim process. ShipWorks also allows users to easily establish automation rules that automatically purchase insurance coverage for specific products and/or orders over a specific value. Consolidating shipping, insurance, and claims management in one program is yet another way ShipWorks can boost your business’ efficiency.

Coverage Details – At the 7 minutes 17 seconds mark

ShipWorks Parcel Insurance covers any shipment up to $5,000, including shipments that do not originate in the United States. The coverage can include product value and shipping costs, by simply inputting the desired amount of coverages inside the ShipWorks interface. Customers will be insured up to the inputted value.

Claims Benefits – At the 10 minutes 4 seconds mark

InsureShip has built a claim process that is as simple and easy while still following the guidelines set by the department of insurance. When filing a claim there is no need to visit a third party website. All insurance claims can be submitted directly through your ShipWorks account or if needed, by using a paper form. Claim resolutions (refunds) are issued within 5-7 business days and are by check or PayPal.

ShipWorks Parcel Insurance vs Declared Value Coverage – At the 11 minutes 40 seconds mark

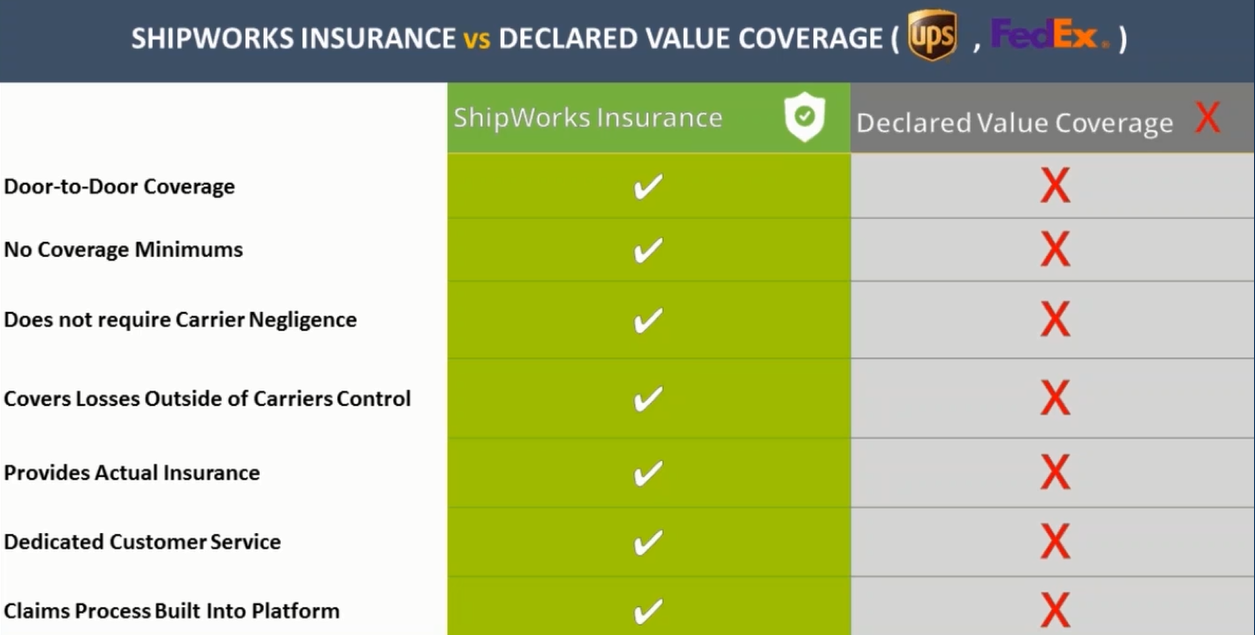

One of the most frequently asked questions is “How is ShipWorks Parcel Insurance different than carrier insurance?” The biggest difference is ShipWorks offers actual parcel insurance versus the “Declared Value Coverage” that is offered by the large shipping carriers. It’s important to note that “Declared Value Coverage” is not insurance – it is protection for a specific event when the package is being transported by the shipping carrier.

There are seven critical benefits that “Declared Value Coverage” does not cover:

Demo: How to Buy Parcel Insurance using ShipWorks – At the 15 minutes mark

Sean Kramer, ShipWorks Enterprise Shipping Consultant, demonstrated the process of how to purchase parcel insurance within the ShipWorks customer interface:

- Adding ShipWorks Parcel Insurance to shipments 15:18

- Making a claim 16:42

- Viewing the status of a claim 17:23

Get more information on ShipWorks Parcel Insurance.