5 Questions You Should Ask When Insuring Ecommerce Orders

Resourceful ecommerce business owners have learned that it’s important to reduce the sting of shrinking margins and protect all revenue. One of the best ways to do this is through shipping insurance. Why insure your ecommerce shipments? Because if you don’t, your business could lose a bundle on lost, damaged, and non-deliverable packages.

To get the maximum benefit out of insuring, it is vital to know some insurance basics so that if something happens to a shipment. This way, you can be fully reimbursed for the lost or damaged item, freight, and other associated costs.

We’ve detailed the 5 questions you should ask before deciding on the best shipping insurance for your ecommerce warehouse:

1. Where should my shipping insurance come from?

Is your shipping insurance through a carrier or a third-party? Getting insurance from a carrier may seem the easiest, but third-party insurance is generally less expensive and provides more coverage. While carriers typically come with a certain amount of included coverage (typically $100), they charge an average of 85 cents for every $100 of insurance (with a $2.55 minimum). Third-party companies charge only about 55 cents for every $100.

For example, ShipWorks Insurance (managed by InsureShip) will charge as little as $1.10 for a package insured at $200, whereas UPS and FedEx have $2.55 minimums for the same package.

2. What type of shipping insurance do I need?

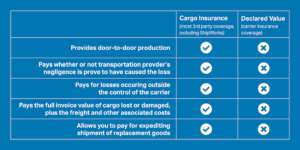

Is it declared value or cargo insurance? These terms are often interchanged, but they’re not synonymous and their coverage varies greatly.

One of the most significant distinctions is that with declared value insurance the shipper must prove that the carrier’s negligence directly resulted in the loss or damage to cargo. This can be very difficult to prove and results in packages that aren’t covered. Comparatively, cargo insurance attaches to the cargo while in transit with coverage being extended warehouse to warehouse. Cargo insurance pays regardless of whether the loss or damage was due to the carrier’s negligence.

Here’s a quick checklist to help you determine which type of shipping insurance best suited for your business:

3. How much coverage do I need?

Insure items for what they are worth in retail channels, or what is most likely to be spent to replace the contents of the package. You are unlikely to get more insurance compensation for the item than its current retail value, so avoid the additional fees associated with higher value insurance coverage.

Do your research to know what you’re really paying for. As we detailed above, most carriers have a $2.55 minimum for insurance values from $0-$300, and then they charge 85 cents for every $100 of insurance after that. It is estimated that over 80% of all packages mailed are under the $300 insurance value limit.

For this reason, it is usually better to go with a third-party insurance provider who will charge 55 cents per $100 of coverage. If you’re sending a package that only needs $100 of insurance, it will cost you $2.55 with a carrier and only 55 cents with a third-party carrier like ShipWorks Insurance. Those savings on shipping insurance add up over time!

4. Should I combine shipping insurance coverage?

Have you ever wanted to combine third party insurance with the complimentary insurance available from carriers? It’s doable, but we don’t recommend it. It may seem counterintuitive, but combining shipping insurance coverage can take a tremendous amount of time and actually cost you more.

Let’s pretend you’re shipping out an ecommerce order and need $200 of insurance. You may want to use the $100 of insurance that is included with many carriers and just purchase the remaining $100 coverage through a third-party insurance provider. Sounds easy, right? Unfortunately, it’s not as seamless as it may initially appear. Here’s why:

You’ve spent much more than you need to. Most carriers will charge $2.55 and it will be declared value coverage. If you use third-party insurance, it will $1.10 and is full cargo insurance, not declared value.

If you have to file a claim, you will be doing it twice. If you decide to try and split insurance coverage and you have to file a claim, you will need to first file the claim with the primary insurer. If the primary insurer denies your claim, the secondary insurer is required by law to abide by the first carrier’s decision. If the primary insurer accepts your claim, you are then required to file a second claim with the secondary insurance carrier. You now get to wait for two different companies to process your claim and pay. Avoid the headache and go with one insurance provider.

5. When should I file an insurance claim?

Start your claim as soon as you realize a package is damaged, lost, or stolen. Carriers and third-party insurance companies have different cutoff times for filing, so make sure you file soon so that you don’t miss the allotted window.

The documentation you need also varies by carrier or third-party insurance provider.

With InsureShip, if your claim is for a lost package, start by filing a tracer with the carrier to see if they can locate the shipment. The entire process can be managed online, once the claim and supporting documents (such as pictures) are submitted, it will take about 7-10 business days for payment. When you use a carrier’s insurance, you need to provide evidence of insurance and mailing the shipment and it usually takes 30-45 days for payment.