Shipping Insurance Essentials

Resourceful business owners have learned that it’s important to protect against risk. For online sellers, one of the best ways to do this is through shipping insurance. To get the maximum benefit out of whatever insurance you purchase, it’s important to learn some vital insurance basics. We’ve learned quite a bit about shipping insurance over the years and we’re happy to share some of our expertise with you.

1. Pricing Insurance: Insurance from the carrier may seem like the easiest choice, but third-party insurance is generally less expensive and provides fuller coverage. Carriers may charge anywhere from $0.90 – $3.00 per $100 of insurance, while third-party companies charge as little as $.55 per $100. ShipWorks Insurance (by InsureShip) costs as little as $1.10 for a package insured at $200, whereas UPS and FedEx have $2.55 minimums for the same package.

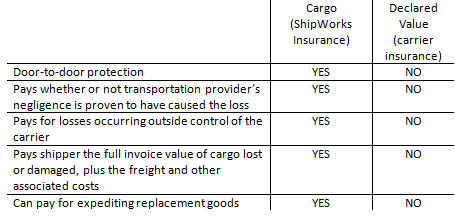

2. Understanding Declared Value v. Cargo Insurance: Declared value and cargo insurance are often used interchangeably, but they’re not synonyms and their coverage varies greatly. One of the most significant distinctions is that with a claim based on declared value the shipper must prove that the carrier’s negligence directly caused the loss or damage to the shipment. This can be difficult to prove and may result in rejected claims. Cargo insurance pays if a shipment was damaged while in transit, warehouse to destination, regardless of who is at fault.

3. Determining how much insurance to buy: Insure items for the replacement cost of the item, or the amount likely to be spent in retail channels to replace the item. It is not likely that you will be compensated for more than current retail value, so do not pay additional fees to get higher insurance values.

4. Factoring Convenience of Claims: Time is money, so you’ve got to consider how easy it is to file a claim with the insurance you’ve chosen. Carriers and third-party insurance companies have different cutoff times for filing, so make sure you file as soon as possible. When you use a carrier’s insurance, you need to gather evidence of insurance and mailing the shipment, and it usually takes 30-45 days for payment. ShipWorks claims can be made any time within 60 days of the ship date, and they are super easy to file. Shipments insured with ShipWorks Insurance are automatically logged on your account and claim forms can be generated almost instantly. The entire process can be managed online, and once the claim and supporting documents are submitted, payments are made within 7 working days.

5. Packaging Shipments: Insurance doesn’t cover packages that bear a descriptive label or otherwise describes the nature of the contents, so when you ship with insurance, you’ve got to use non-descriptive packaging.

For more information about using ShipWorks Insurance, please see www.shipworks.com/insurance.